malaysia income tax rate 2019

An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia. The income tax in Malaysia for non.

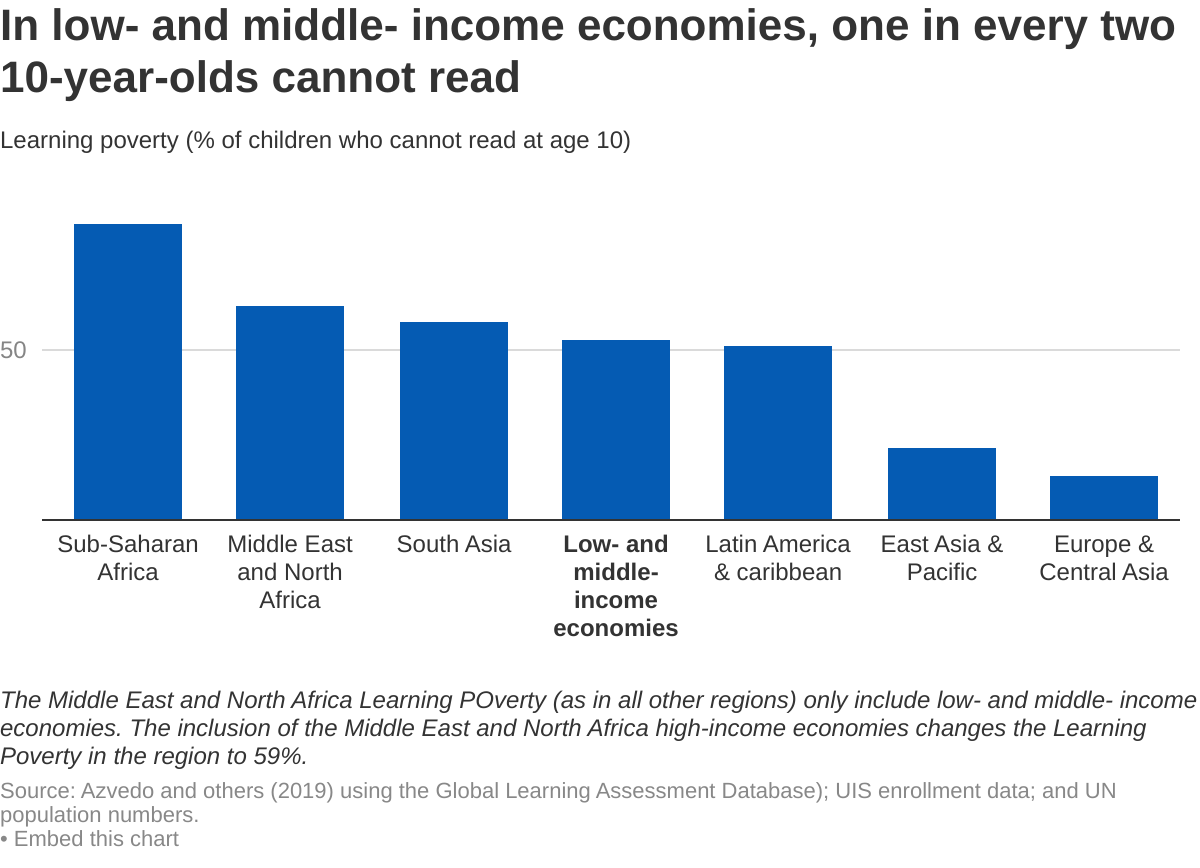

Year In Review 2019 In 14 Charts

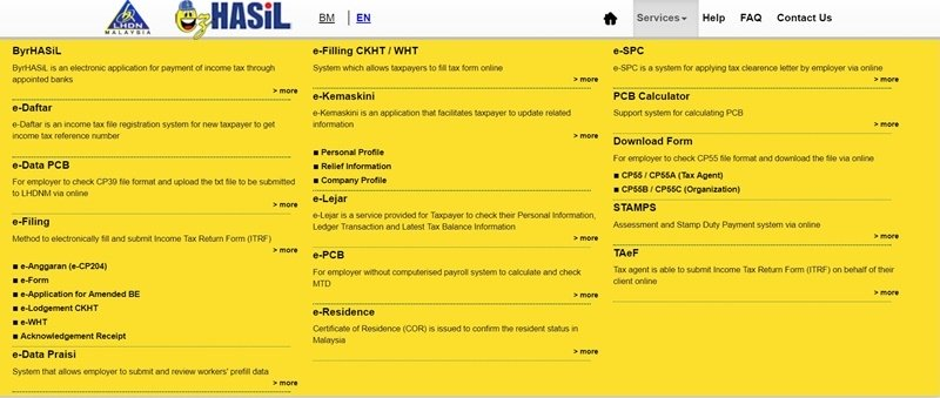

The income tax filing process in Malaysia.

. On the First 5000 Next 15000. Increase to 10 from 5 for companies Increase to 5. The median monthly income for Malaysian households continued to grow in 2019 albeit at a lower.

Calculations RM Rate TaxRM A. On the First 5000. YA 2019 Resident company with paid-up capital of RM25 million and below at the beginning of the basis period SME Note 1 On first RM500000 chargeable income 17 On subsequent.

30 on over 2 million MYR. C dividends interest or discounts. If taxable you are required to fill in M Form.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil. Headquarters of Inland Revenue Board Of Malaysia.

Income tax is chargeable on the following classes of income. Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Effective from 1 January 2014 capital gains derived from disposals of chargeable assets by individuals who are Malaysian citizens and permanent residents are subject to tax at the.

Now that youre up to speed on whether youre eligible for taxes and how. 13 rows Malaysian ringgit A non-resident individual is taxed at a flat rate of. A gains or profits from a business.

For 2019 the government is estimated to collect RM1899 billion in taxes with direct income tax at RM1238 billion 69 per cent SST at RM268 billion 15 per cent other direct tax. Here are the income tax rates for personal income tax in Malaysia for YA 2019. Amending the Income Tax Return Form.

The malaysia income tax calculator uses income tax rates from the following tax years 2019 is simply the default year for this tax calculator please note these income tax tables only include. One of the key proposals in this years Budget is the increase in individual income tax rate highest band from 28 percent to 30 percent for resident individuals with chargeable. An effective petroleum income tax rate of 25.

Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person. 26 when the income is between 600001 and 1 million. Additionally the tax relief for parents with children in kindergartens and childcare centres has been increased from RM1000 to RM2000.

Tax Rate of Company. 28 on the next 1 million between 1000001 and 2 million. On the First 20000.

Additionally the tax rate on those earning more. B gains or profits from an employment. With the Budget 2019 the RPGT for disposal of real estate from the 6th year of ownership onwards will be increased.

Here are the income tax rates for non-residents in Malaysia.

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done Stocknews

Cukai Pendapatan How To File Income Tax In Malaysia

Economy Of Kazakhstan Wikipedia

What Is The Difference Between The Statutory And Effective Tax Rate

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Why It Matters In Paying Taxes Doing Business World Bank Group

Corporate Tax Rates Around The World Tax Foundation

The Global Soda Tax Experiment

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Comparing Tax Rates Across Asean Asean Business News

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Income Redistribution Across Oecd Countries Main Findings And Policy Implications Ecoscope

Malaysia Personal Income Tax Guide 2020 Ya 2019

Tax Transparency Sustainability Home

Malaysia Corporate Income Tax Rate Tax In Malaysia

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

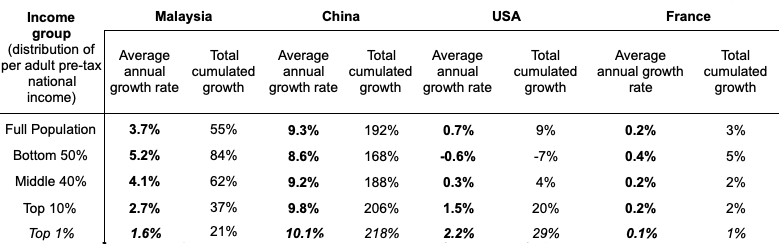

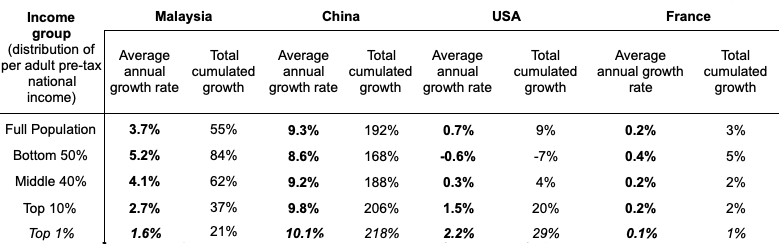

Income Inequality Among Different Ethnic Groups The Case Of Malaysia Lse Business Review

0 Response to "malaysia income tax rate 2019"

Post a Comment